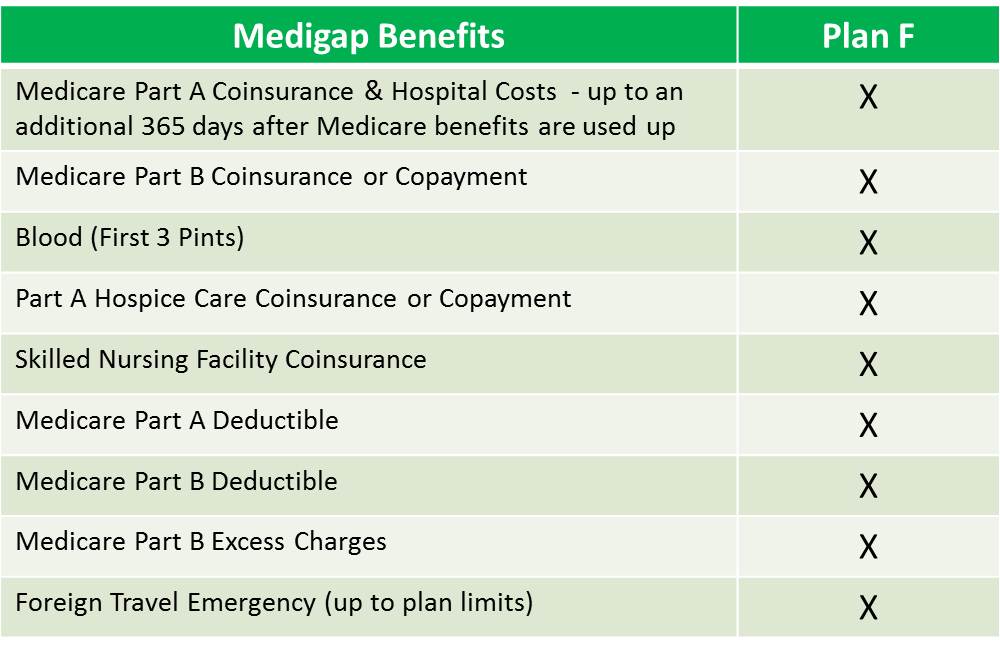

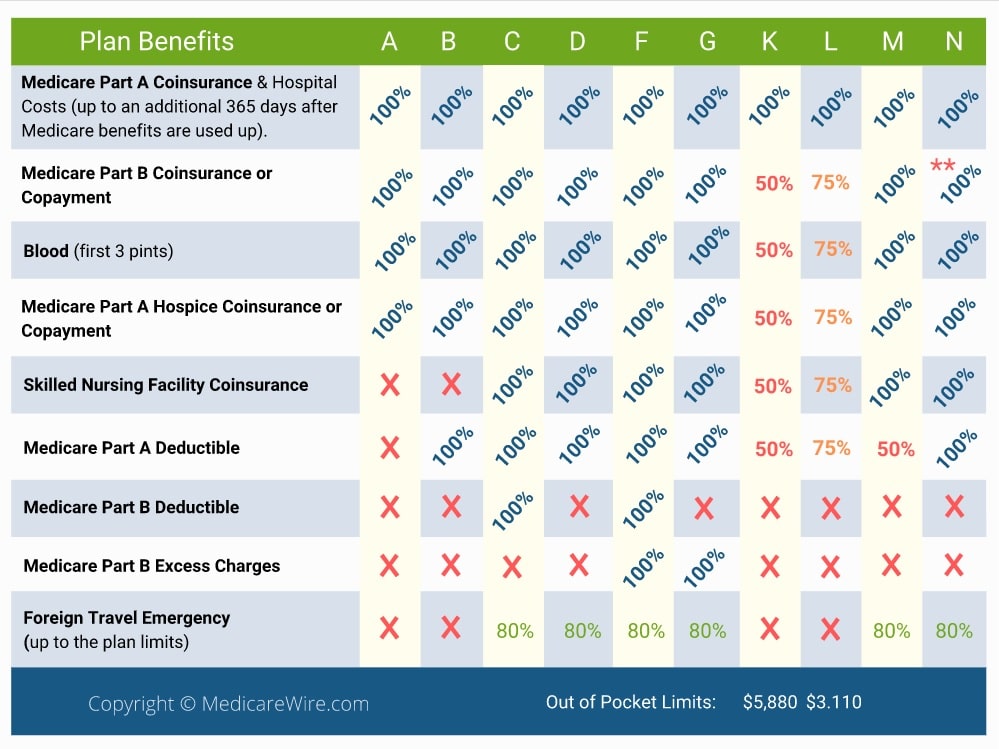

This leaves the remaining 20 of expenses to be the responsibility of the Medicare patient. Beyond that Part F is the most comprehensive of all the MedSup plans on the market today.

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medicare Part F Benefits.

What does part f cover. It even covers a. If you are enrolled in Medicare Part C a private alternative to Original Medicare then you cannot get a Medigap policy. 3440 What does this part cover.

Plan N is two steps down from Plan F in terms of coverage. Outside of the monthly premium you never need to pay out-of-pocket. Plan F Coverage of Medicare Part A Expenses.

The current offer was effective May 1 2005 and will continue until terminated by the Secretary. This part applies to the transfer of funds by the Automated Clearing House method as used by us in connection with United States securities. Generally Medicare covers approved charges for hospitalization at 80.

Part A is insurance for hospital care and Part B covers doctor and outpatient insurance. This part is the offering of United States Savings Bonds of Series EE referred to as Series EE bonds or bonds for sale to the people of the United States by the Secretary of the Treasury Secretary. Series EE bonds have been offered since 1980.

No coinsurance to share the cost of healthcare. 2241 What does this part cover. Plan F also covers the Part A deductible which resets with each new benefit period typically when youre admitted into the hospital the next time.

What Does Medicare Plan F Cover. Foreign travel Original Medicare doesnt pay for health care costs incurred abroad but Plan F can cover up to 80 of those costs. Well help you understand when Plan F is the best choice for you and whether youre eligible.

3700 What does this part cover. Plan F covers all cost-sharing services for Plan A and Plan B. Medicare Plan F covers many different things and as long as Medicare approves the charge you will typically have no out-of-pocket cost at all.

The Secretary of the Treasury the Secretary offers for sale non-marketable State and Local Government Series SLGS securities to provide issuers of tax-exempt securities with investments from any eligible source of funds as defined in 3441. Medicare Part F is one of the 10 MedSup policies Americans enrolled in Original Medicare can buy if they want additional health coverage or if they want help paying for their Medicare Part A and Part B coverage. It also covers physician services speech and physical therapy durable medical equipment diagnostic tests supplemental Medicare coverage for skilled nursing facility care.

These checks referred to as fiscal agency checks are issued by a designated Federal Reserve Bank in its capacity as fiscal agent of the United States. This includes your deductibles coinsurance and copays when receiving medical care. The checks are drawn on the payor Federal Reserve Bank in its banking capacity.

This part provides guidance on when a surety corporation must appoint a service of process agent and how the surety corporation complies with this. They are designed to cover out-of-pocket expenses for Original Medicare. If you have Plan F you will need to enroll in separate dental coverage.

However it is not available to everyone who is eligible for Medicare. No deductibles to pay before coverage kicks in. Medicare Supplement Insurance is offered by private insurance companies and comes with its own costs like a premium and deductible.

No co-payments at the time of service. This part governs checks issued for payments in connection with United States securities. Medicare Supplement insurance plans such as Plan F do not include coverage for routine dental care.

Plan F is a Medigap plan offering comprehensive coverage. It covers 100 of your out-of-pocket costs. Medicare Part B Medical ServicesWhat Plan F Pays Per Calendar Year Medical Expenses Includes expenses in or out of the hospital and outpatient hospital treatment such as physicians services inpatient and outpatient medical and surgical services and supplies physical and speech therapy diagnostic tests and durable medical equipment.

Because Plan F covers most remaining hospital and doctor costs after Original Medicare Part A and Part B has paid its share its possible for beneficiaries with this plan to not have any or minimal other hospital and medical expenses. Blue Cross Medicare Supplement Plan F includes supplemental Medicare coverage for medical services covered in Part B including outpatient and medical services in or out of the hospital. This part also provides regulations for the electronic submission of transaction requests through us except as varied by agreement or as otherwise provided.

3510 What does this part cover. Part A is the hospitalization component of Original Medicare and covers Medicare expenses typically associated with a hospital stay. A What is the purpose of the SLGS securities offering.

Plan F is a very comprehensive plan helping cover expenses that original Medicare doesnt. Plan F covers the Medicare-approved expenses not covered under Medicare Part A deductibles coinsurances and copays. 3550 What does this part cover.

Plan F is for beneficiaries looking for full coverage for all out-of-pocket costs including deductibles coinsurance and copayments.

What Does Plan F Cover Medicare Plan F Coverage

What Does Plan F Cover Medicare Plan F Coverage

What Is Medicare Supplement Plan F Gomedigap

What Is Medicare Supplement Plan F Gomedigap

Medicare Supplement Plans Medigap Blue Sky Medicare

Medicare Plan F Medigap Plan F Senior Healthcare Direct

Medicare Plan F Medigap Plan F Senior Healthcare Direct

Medigap Plan F Medicare Supplement Plan F Medicarefaq

Medigap Plan F Medicare Supplement Plan F Medicarefaq

Medicare Supplement Plan F Best Quote Insurance

Medicare Supplement Plan F Best Quote Insurance

How Much Does Medigap Plan F Cost

How Much Does Medigap Plan F Cost

Medigap Plan F Yourmedicareupdate Com

Medigap Plan F Yourmedicareupdate Com

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

How Does High Deductible Medigap Plan F Work Medicaresupplement Com

How Does High Deductible Medigap Plan F Work Medicaresupplement Com

Plan F Or Plan G Medigap Plans F G 65medicare Org

Plan F Or Plan G Medigap Plans F G 65medicare Org

Comparing Medicare Supplement Plan F G Medicarehaven Com

Comparing Medicare Supplement Plan F G Medicarehaven Com

Medicare Supplement Plan F 7 Essential Facts You Must Know Clear Medicare Solutions

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.