Small businesses can get comprehensive coverage from CareFirst BlueCross BlueShield. A growing number of small businesses band together with other entrepreneurs to enjoy economies of scale and gain.

9 Reasons To Offer Small Business Health Insurance

9 Reasons To Offer Small Business Health Insurance

Blue365 offers access to savings on items that Members may purchase directly from independent vendors which are different from items that are covered under the policies with Blue Cross NC.

Small business employee insurance plans. To cut quickly through the insurance jargon it stands for Qualified Small Employer Health Reimbursement Arrangement by the way a QSEHRA allows small employers businesses with less than 50 FTEs to set aside a fixed amount of money each month up to 44167 per month for individuals and 89167 for families in 2021 that employees can use to. And Northern Virginia over 70 of small businesses offering health insurance choose CareFirst. Offer health insurance to all full-time employees.

As a small business with less than 50 full-time equivalent employees you are not required to offer group health insurance. Here is an overview of how a small business can qualify for a tax credit when offering employees health insurance. Blue Cross and Blue Shield of Texas BCBSTX has the flexibility and choice that growing companies need.

Self-insured funding built for small businesses Control rising health care costs with Aetna Funding Advantage SM health plans. An average eHealth small business plan covers 5 people and costs 1432 per month in premiums - or 286 per person. Health insurance plans available to small businesses have several advantages over those available to individuals both in the quality of plans and costs of the plans.

This works in the. Health insurance is one factor in retaining and recruiting employees and we are here to help you be a smart shopper. Our flexible affordable options will help keep your employees healthy while also controlling your costs.

Small Business Health Options Program HealthCaregov Health insurance for your business and employees Offering health benefits is a major decision for businesses. There is a total of six plan options with varying costs by state. Association health plans.

Kaisers small business insurance plans focus on companies with two to 100 employees. BCBSTX provides small business employers with a variety of plan options that include access to a large network of health care providers and comprehensive benefits to fit your employees needs and your organizations budget. Pay at least 50 of the health insurance costs.

In Maryland Washington DC. Pay your FTEs an average of 50000 a year. But small business health insurance is a must if youre looking to grow.

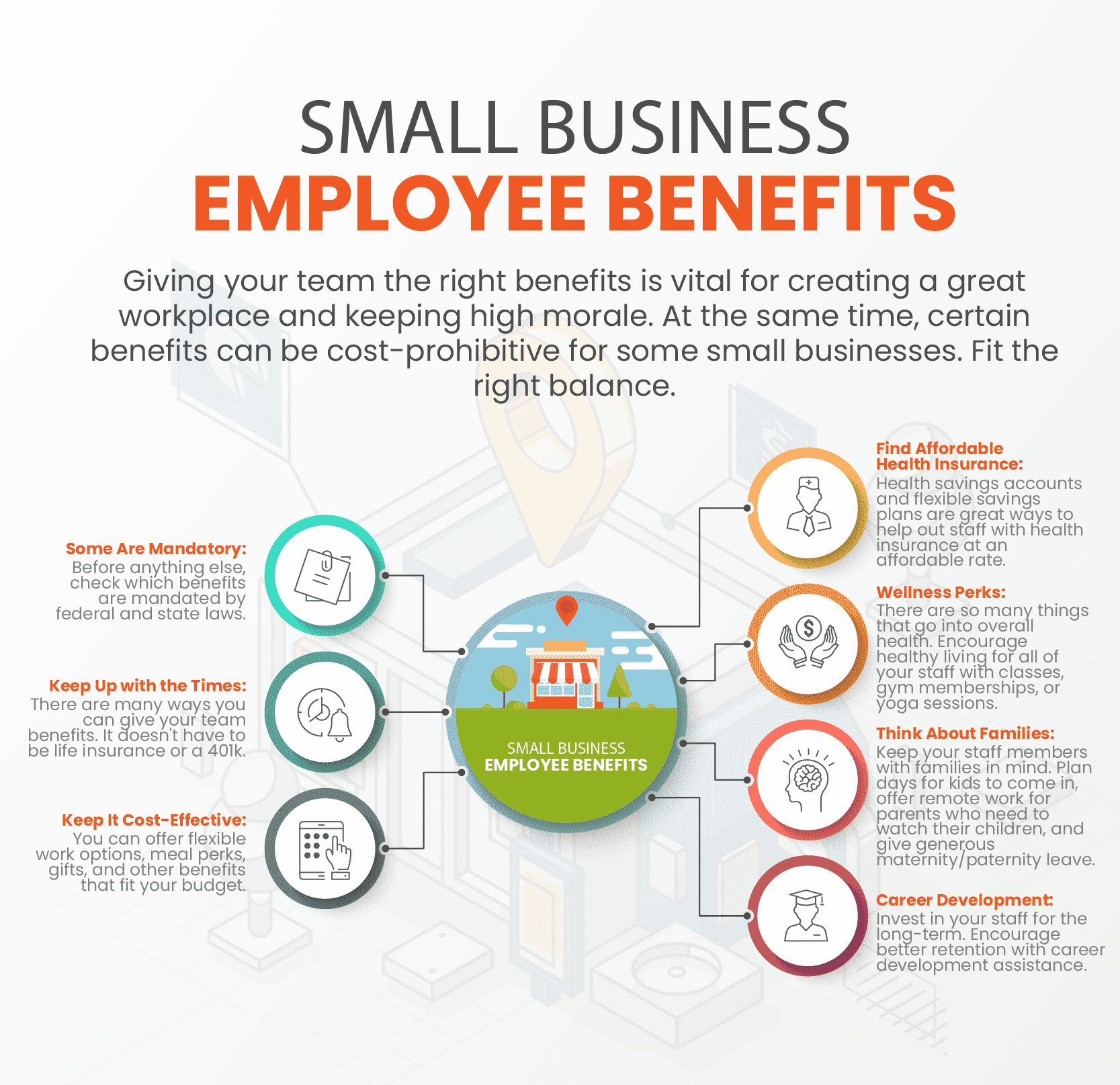

And these issues can lead to liability issues for businesses especially if you collect personal financial or other sensitive data from customers or other third parties. Small business employee health Insurance health benefits coverage. It can help attract and retain better employees improve productivity by keeping everyone healthy and might even save you.

GroupHEALTH offers your business 3-15 employees the right plan components for your employees build the best plan for your small business Call today. For a small business health insurance is a critical factor in retaining and recruiting employees as well as maintaining productivity and employee satisfaction. Small business health insurance with Humana Our health insurance plans for small businesses companies with 2 to 50 employees helps you save money and help keep your employees healthy.

Tax Deductible Premiums Health insurance premiums on small business plans are tax deductible for both the company and employees reducing the cost of coverage by 25-40. Small businesses can join with other small companies to buy large-group health insurance which is reserved for companies with more than 50 employees. You can get the benefits typical for larger groups like surplus sharing fewer taxes and fees and high-cost claims protection.

If your company does decide to offer health coverage to your employees then you are typically required to pay for at least 50 percent of employee premiums as a small employer. Have 25 or fewer FTEs. Small Business Insurance Plans.

All in one offering specially designed with your small business in mind. UnitedHealthcare offers a wide range of group health insurance options designed to help your small business save money and support your employees health and wellbeing. The number of cybersecurity breaches in the US.

Use HealthCaregov as a resource to learn more about health insurance products and services for your employees. There are ways to cut costs without cutting into your employees insurance plan. Here are a few of them to consider.

Has grown rapidly in recent years.

9 Reasons To Offer Small Business Health Insurance

9 Reasons To Offer Small Business Health Insurance

9 Reasons To Offer Small Business Health Insurance

9 Reasons To Offer Small Business Health Insurance

Group Health Insurance In California For Small Business

Group Health Insurance In California For Small Business

The Small Business Open Enrollment Guide Ehealth

The Small Business Open Enrollment Guide Ehealth

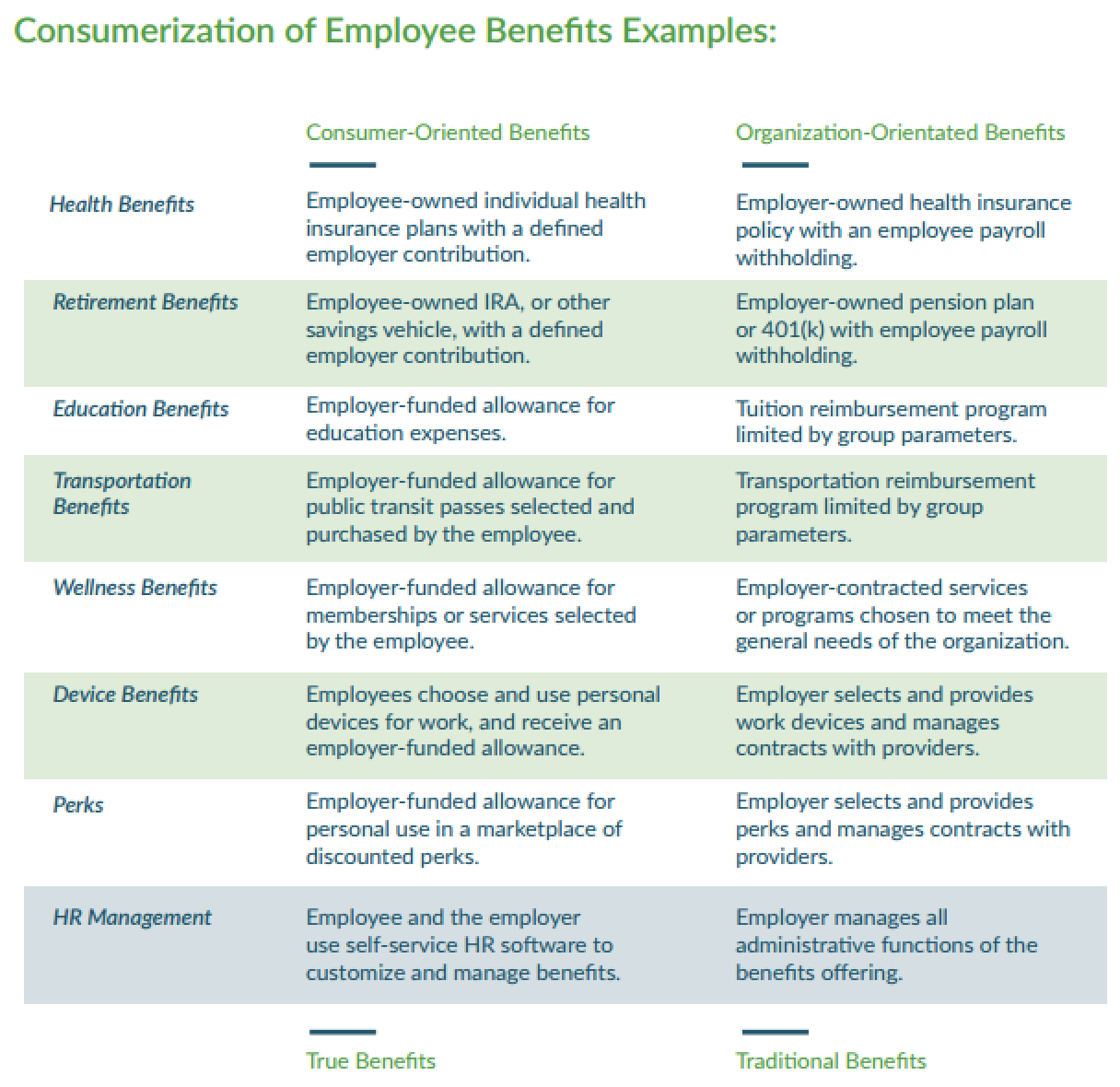

What Are Consumerized Employee Benefits

What Are Consumerized Employee Benefits

![]() Group Health Insurance Coverage Group Health Organization

Group Health Insurance Coverage Group Health Organization

What Benefits Are Included In A Small Group Health Insurance Plan

What Benefits Are Included In A Small Group Health Insurance Plan

Affordable Small Business Employee Benefits For 2021

Affordable Small Business Employee Benefits For 2021

Small Business 101 The Definition Of Employee Benefits

Small Business 101 The Definition Of Employee Benefits

Employee Benefits In A Small Business

Employee Benefits In A Small Business

Can A Business Reimburse An Employee For Health Insurance Picshealth

Can A Business Reimburse An Employee For Health Insurance Picshealth

Study Less Than Half Of Small Businesses Offer Employee Benefits

Health Insurance For Small Business Cost Features Providers

Health Insurance For Small Business Cost Features Providers

Health Insurance For Small Business Guide To Options And Costs

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.